Forsyth County resident and animal advocate Sue Bova suffered a major loss Feb. 14 when a suspected short in an electrical panel resulted in a fire at her home. Read moreForsyth County resident urges safety following house fire

Trending In Forsyth

-

Alpharetta planners give nod to condo project downtown

-

Tractor Supply seeks Atlanta market with location near North Point Mall

-

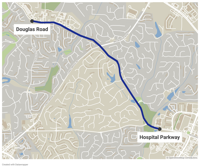

Cyclist seeks citizen involvement as Johns Creek adds bike lanes

-

Alpharetta may swap playground for parking at Union Hill Park

-

Roswell's Lanada Duncan transforms homes into personal retreats

Forsyth County resident and animal advocate Sue Bova suffered a major loss Feb. 14 when a suspected short in an electrical panel resulted in a fire at her home. Read moreForsyth County resident urges safety following house fire

Top Business News

Top School News

More School News

Top Government News

- Johns Creek to renovate amphitheater at Autrey Mill Nature Preserve

- Daffodil Days ushers in springtime

- North Fulton Master Gardeners set date for annual Garden Faire

- Forsyth County putting ‘finishing touches’ on McGinnis Ferry Road redesign

- Opinion: Everything you need to know about the 2024 Garden Faire

- Milton man to count 50 years in Peachtree Road Race this July

- North Fulton Master Gardeners set date for annual Garden Faire

- Local developers curate Crabapple’s new mid-rise development

- Opinion: Everything you need to know about the 2024 Garden Faire

- Milton City Council talks active parks, denies alcohol license

- Forsyth County putting ‘finishing touches’ on McGinnis Ferry Road redesign

- Forsyth schools record growth in English learning population

- Forsyth libraries hosting exhibit detailing history of Fox Theatre

- Fundraiser, dinner to highlight food disparity in Forsyth County

- Cumming veterans group sets deadline for $5,000 scholarship award